Insurance Agency Mergers and Acquisitions First Nine Months of 2019 Break Record, OPTIS Partners Reports

ACCESS Newswire

08 Oct 2019, 18:35 GMT+10

Data Covering Property & Casualty and Employee Benefits Brokers Shows that Big Players Continue to Pay Top Dollar for Acquisitions in the US and Canada

CHICAGO, IL / ACCESSWIRE / October 8, 2019 / There were 490 announced insurance agency mergers and acquisitions during the first three quarters of the year, according to OPTIS Partners' M&A database. It was the highest nine-month total ever, beating the 481 deals announced in 2018.

The data covers U.S. and Canadian agencies selling primarily property-and-casualty insurance, agencies selling both P&C and employee benefits, and those selling only employee benefits.

There were 158 transactions in the third quarter alone, making it the second most-active third quarter ever.

'Agency valuations continue pushing new upper limits, and there are no signs of any slowdown in M&A activity,' said Daniel P. Menzer of OPTIS Partners, an investment banking and financial consulting firm specializing in the insurance industry.

Deals by Buyer Type

The OPTIS Partners report breaks down buyers into four groups: private equity-backed/hybrid brokers, privately held brokers, publicly held brokers, and all others.

PE/hybrid buyers continue to lead all buyer groups with 66 percent of the total transactions through the first nine months (320 in total). Acquisitions by privately owned agencies were the next most active group, accounting for 20 percent of deals.

For the nine-month period, Acrisure led all buyers with 71 transactions, followed by Hub International Limited (37), Gallagher (27), Broadstreet Partners (27), and AssuredPartners (26).

Deals by Seller Type

The reports break down sellers into four groups: property & casualty brokers, P&C/benefits brokers, employee benefits agencies, and all others.

Sales of P&C agencies continue to dominate the seller landscape with 252 announced transactions, followed by employee benefits agencies (123 sales), P&C/benefits brokers (63 deals), and all others (52 transactions).

'Recent economic data is somewhat mixed but generally less optimistic than in recent periods. We'll have to wait and see what, if any, impact this has on buyer appetites and valuation practices,' said Timothy J. Cunningham, managing partner with OPTIS Partners.

A few of the larger buyers have been acquiring stand-alone wealth management/investment advisory firms. Thus far, OPTIS has not included these transactions in its report.

Canadian Activity

37 out of the 490 reported deals took place in Canada, representing approximately 7.6 percent of the total, the highest percentage of Canadian-based sellers, and second only to California (65) in the number of transactions in 2019.

Not all transactions are announced, so the actual number of agency sales undoubtedly exceeded the number reported, according to Menzer.

'But our data collection process is consistent from period to period and includes a variety of sources. We're confident the deal activity measured over time reflects of the overall M&A marketplace,' he said.

The full report can be read at http://optisins.com/wp/2019/10/september-2019-ma-report.

OPTIS Partners was ranked in the top five most active agent-broker M&A advisory firms for 2014 - June 2019 by S&P Global Market Intelligence.

Focused exclusively on the insurance-distribution marketplace, Chicago-based OPTIS Partners (www.optisins.com) offers merger & acquisition representation for buyers and sellers, including due-diligence reviews. It provides appraisals of fair market value; financial performance review, including trend analysis and internal controls; and ownership transition and perpetuation planning.

Contact: Tim Cunningham, OPTIS Partners, [email protected], 312-235-0081

Dan Menzer, OPTIS Partners, [email protected], 630-520-0490

Henry Stimpson, Stimpson Communications, 508-647-0705 [email protected]

SOURCE: OPTIS Partners

View source version on accesswire.com:

https://www.accesswire.com/562349/Insurance-Agency-Mergers-and-Acquisitions-First-Nine-Months-of-2019-Break-Record-OPTIS-Partners-Reports

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Los Angeles Herald news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Los Angeles Herald.

More InformationInternational

SectionTragedy in Spain: Diogo Jota and his brother die in car accident

MADRID, Spain: Liverpool footballer Diogo Jota and his younger brother, André Silva, have died in a car accident in Spain. Spanish...

Early heatwave grips Europe, leaving 8 dead and nations on alert

LONDON, U.K.: An unrelenting heatwave sweeping across Europe has pushed early summer temperatures to historic highs, triggering deadly...

U.S. military, China, Russia in Space race

President Donald Trump's plans to build a space-based Golden Dome missile defense shield have drawn immediate criticism from China,...

Trump wins $16 million settlement from Paramount over CBS Harris edit

NEW YORK CITY, New York: Paramount has agreed to pay US$16 million to settle a lawsuit brought by U.S. President Donald Trump over...

British PM faces major party revolt over welfare reforms

LONDON, U.K.: British Prime Minister Keir Starmer won a vote in Parliament this week to move ahead with changes to the country's welfare...

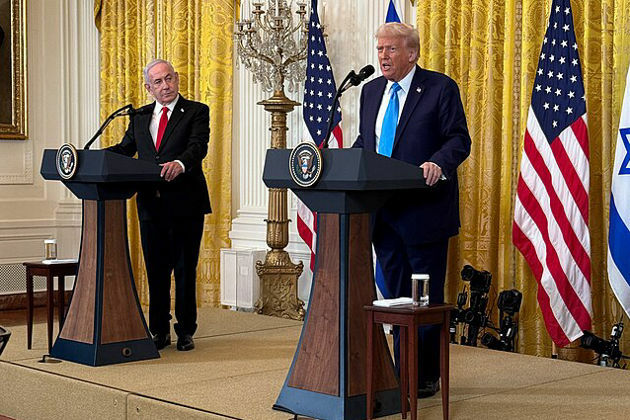

White House meeting between Trump, Netanyahu on July 7

WASHINGTON, D.C.: President Donald Trump will meet Israeli Prime Minister Benjamin Netanyahu at the White House on Monday. President...

California

SectionNvidia briefly tops Apple’s record in AI-fueled stock rally

SANTA CLARA, California: Nvidia came within a whisker of making financial history on July 3, briefly surpassing Apple's all-time market...

ICE raids leave crops rotting in California, farmers fear collapse

SACRAMENTO, California: California's multibillion-dollar farms are facing a growing crisis—not from drought or pests, but from a sudden...

Grammarly acquires Superhuman to boost AI workplace tools

SAN FRANCISCO, California: Grammarly is doubling down on AI-powered productivity tools with the acquisition of Superhuman, a sleek...

Robinhood launches stock tokens for EU investors, adds OpenAI

MENLO PARK, California: Robinhood is giving European investors a new way to tap into America's most prominent tech names — without...

Trump hints at DOGE investigation of Musk subsidies

WASHINGTON, DC - U.S. President Donald Trump on Tuesday claimed Elon Musk's success has been built on government subsidies. Without...

Nvidia execs sell $1 billion in stock as AI boom drives record prices

SANTA CLARA, California: Executives at Nvidia have quietly been cashing in on the AI frenzy. According to a report by the Financial...